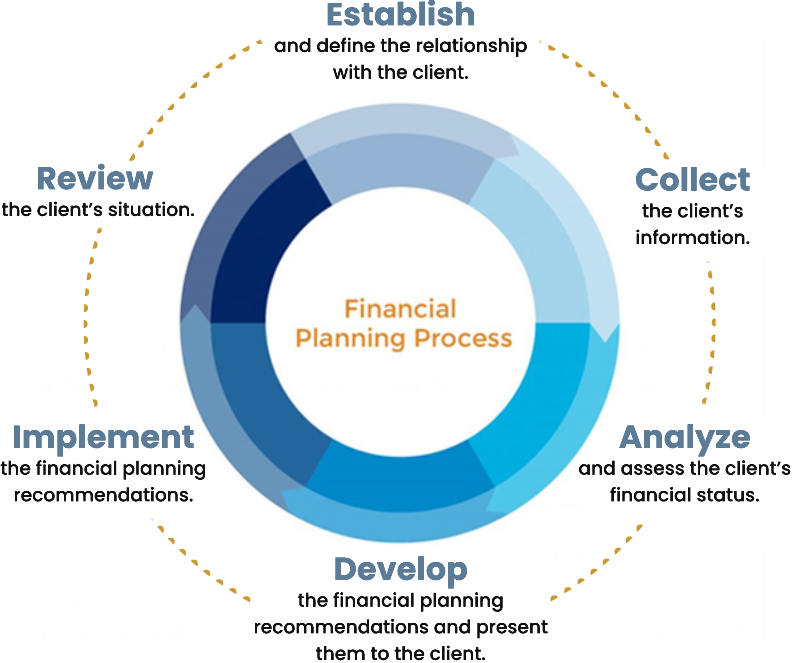

Financial Planning Process

Fresh Bread Investments follows the Financial Planning Standards Board’s Financial Planning process, explained and depicted below.

FPSB’s Financial Planning Process is a collaborative, iterative approach that financial planning professionals use to consider all aspects of a client’s financial

situation when formulating financial planning strategies and making recommendations. For more info on The FPSB please visit www.fpsb.org

Establish and define the relationship with the client.

The financial planning professional informs the client about the financial planning process, the services the financial planning professional offers, and the financial planning professional’s competencies and experience.

Collect the client’s information.

The financial planning professional and the client identify the client’s personal and financial objectives, needs and priorities that are relevant to the scope of the engagement before making and/or implementing any recommendations.

Analyze and assess the client’s financial status.

The financial planning professional analyzes the client’s information, subject to the scope of the engagement, to gain an understanding of the client’s financial situation.

Develop the financial planning recommendations and present them to the client.

The financial planning professional considers one or more strategies relevant to the client’s current situation that could reasonably meet the client’s objectives, needs and priorities; develops the financial planning.

Implement the financial planning recommendations.

The financial planning professional and the client agree on implementation responsibilities that are consistent with the scope of the engagement, the client’s acceptance of the financial planning recommendations, and the financial planning professional’s ability to implement the financial planning recommendations.

Review the client’s situation.

The financial planning professional and client mutually define and agree on terms for reviewing and reevaluating the client’s situation, including goals, risk profile, lifestyle and other relevant changes.